Exactly how to Pick one of the most Reputable Secured Credit Card Singapore for Your Needs

Exactly how to Pick one of the most Reputable Secured Credit Card Singapore for Your Needs

Blog Article

Introducing the Opportunity: Can Individuals Discharged From Bankruptcy Acquire Credit Score Cards?

Recognizing the Effect of Insolvency

Insolvency can have an extensive effect on one's credit score, making it testing to gain access to credit rating or car loans in the future. This economic stain can remain on credit scores reports for several years, affecting the person's capacity to protect beneficial passion rates or financial possibilities.

Moreover, personal bankruptcy can restrict work opportunities, as some companies perform credit report checks as part of the hiring procedure. This can position an obstacle to individuals looking for brand-new work prospects or occupation innovations. Overall, the impact of insolvency expands past economic constraints, influencing various aspects of an individual's life.

Aspects Influencing Charge Card Approval

Acquiring a credit rating card post-bankruptcy is contingent upon various essential elements that considerably affect the approval procedure. One vital element is the applicant's credit rating. Adhering to bankruptcy, individuals commonly have a reduced credit rating as a result of the negative influence of the bankruptcy declaring. Charge card firms normally look for a credit scores score that demonstrates the applicant's ability to take care of credit report properly. Another necessary consideration is the applicant's revenue. A steady earnings reassures credit card providers of the individual's ability to make prompt payments. In addition, the length of time given that the insolvency discharge plays a vital duty. The longer the period post-discharge, the extra positive the opportunities of approval, as it shows financial stability and responsible credit score habits post-bankruptcy. In addition, the type of credit scores card being made an application for and the issuer's details requirements can also impact approval. By carefully taking into consideration these elements and taking steps to rebuild credit history post-bankruptcy, people can enhance their potential customers of getting a bank card and functioning in the direction of financial healing.

Steps to Rebuild Credit History After Insolvency

Restoring credit rating after personal bankruptcy calls for a tactical strategy concentrated on monetary self-control and constant financial debt monitoring. The primary step is to evaluate your credit score record to make certain all financial obligations included in the personal bankruptcy are precisely reflected. It is important to establish a budget that focuses on debt payment and living within your means. One reliable technique is to acquire a protected credit rating card, where you transfer a specific quantity as collateral to develop a credit line. Prompt payments on this card can demonstrate responsible credit rating use to possible loan providers. In addition, consider ending up being an accredited user on a family members participant's charge card or checking out credit-builder fundings to more increase your credit rating score. It is vital to make all payments on time, as settlement background considerably impacts your credit rating click here now rating. Perseverance and determination are crucial as restoring credit takes time, however with dedication to sound economic methods, it is feasible to boost your creditworthiness post-bankruptcy.

Safe Vs. Unsecured Credit Report Cards

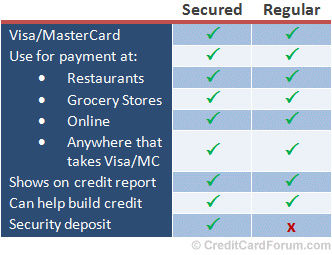

Adhering to bankruptcy, individuals frequently consider the choice in between secured and unsafe bank card as they aim to restore their creditworthiness and monetary security. Secured bank card require a money down payment that works as collateral, generally equivalent to the credit line approved. These cards are less complicated to obtain post-bankruptcy considering that the deposit lessens the threat for the issuer. Nevertheless, they might have higher charges and rate of interest compared to unsecured cards. On the various other hand, unsafe bank card do not call for a down payment but are tougher to get after bankruptcy. Companies analyze the applicant's credit news reliability and might offer lower fees and rate of interest rates for those with an excellent monetary standing. When determining in between both, people should weigh the benefits of simpler approval with guaranteed cards against the potential prices, and consider unsecured cards for their long-term financial objectives, as they can assist reconstruct credit report without binding funds in a down payment. Inevitably, the option in between secured and unsecured bank card must straighten with the individual's financial objectives and ability to manage credit history responsibly.

Resources for Individuals Seeking Debt Restoring

For individuals intending to enhance their creditworthiness post-bankruptcy, checking out available sources is vital to successfully navigating the credit history rebuilding procedure. secured credit card singapore. One important source for individuals seeking debt restoring is debt therapy firms. These companies supply monetary education and learning, budgeting aid, and customized debt improvement plans. By functioning with a credit score therapist, individuals can gain understandings right into their credit rating reports, learn approaches to increase their credit report, and obtain support on managing their finances properly.

An additional valuable resource is credit score tracking services. These solutions enable individuals to maintain a close eye on their debt records, track any type of modifications or inaccuracies, and discover potential signs of identification theft. By checking their credit scores frequently, people can proactively attend to any issues that might make sure and occur that their credit history information depends on day and accurate.

In addition, online tools and sources such as debt score simulators, budgeting applications, and economic proficiency sites can provide individuals with beneficial info and tools to help them in their credit report rebuilding trip. secured credit card singapore. By leveraging these sources efficiently, people discharged from bankruptcy can take significant actions in the direction of boosting their debt health and protecting a better monetary future

Verdict

To conclude, individuals discharged from insolvency might have the possibility to get bank card by taking steps to rebuild their credit report. Web Site Factors such as credit history debt-to-income, earnings, and history ratio play a substantial duty in charge card approval. By comprehending the impact of insolvency, selecting in between secured and unprotected charge card, and making use of sources for credit scores restoring, people can enhance their credit reliability and possibly acquire access to credit report cards.

By functioning with a credit rating counselor, individuals can obtain insights right into their credit history records, learn strategies to increase their credit rating ratings, and obtain support on managing their finances successfully. - secured credit card singapore

Report this page